Frequently Asked Questions

The world of merchant accounts and credit card processing is constantly changing, especially with new technology and services constantly being developed and offered.

We present here questions and answers and helpful articles to keep you educated on new and trending subjects.

1. How does credit card payment processing work?

2. How do the new IRS rules for transaction reporting affect me and my merchant account?

3. What is Near Field Communication (NFC)?

4. How will the new Google/Android relationship with MasterCard/Citi Group/Verifone change Near Field Communications (NFC)?

5. Google, Citi, MasterCard, FISERV and Sprint Team Up to Make Your Phone Your Wallet

6. Where are things headed with mobile phones and mobile payment services?

7. What are the Interchange Table rates for Visa and Mastercard?

8. What are the California Public Utilities Commission's (CPUC) requirements for diversity in contracting?

9. What are the requirements of the Payment Card Industry Data Security Standard Compliance (PCI DSS) Program?

10. What is the best way to handle chargebacks?

11. My PIN pad has stopped working - how do I get it fixed?

1. How does credit card payment processing work?

Credit card payment processing for a store/merchant takes place in two phases:

A. Authorization (getting approval for the transaction that is stored with the order)

B. Settlement (processing the sale which transfers the funds from the issuing bank to the merchant's account).

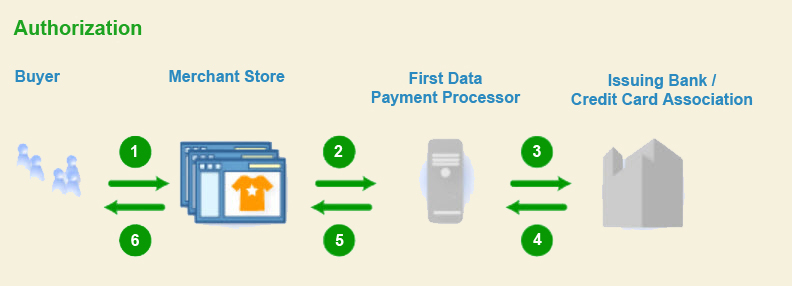

The flow charts below represent the key steps in the process starting from what a customer sees when placing an order through completing the sale and finishing with the merchant processing the sale to collect funds.

A. Authorization

- When the buyer clicks the "Checkout" button, they are sent to secure servers to complete the checkout process. The Buyer (cardholder) places an order at the merchant's site by clicking the "Send Order" button on the Review Order page during checkout.

- The merchant's gateway sends the authorization request to FISERV Merchant Services (FDMS), the payment processor.

- FDMS sends the authorization request to the issuing bank (or credit card association). The authorization request includes:

- the credit card number

- expiration date

- the billing address (used for AVS validation)

- the CVV number (if entered)

- the amount of the order

- validates the card number and expiration

- checks the amount of the order against the available credit

- checks the billing address provided against the billing address on file

- validates the CVV number (if provided)

- The issuing bank (or Credit Card Association) sends the authorization response to FDMS. The authorization response consists of either an approval along with Address Verification System (AVS) and Card Verification Value (CVV) response codes or a decline.

- FDMS adds response codes to the authorization response and passes the authorization back to the merchant's gateway. If the merchant has enabled Risk Tools, the rules set by the merchant will be run when the response is received from FDMS. The authorization (if approved) is stored on secure servers at FISERV for later processing by the merchant.

- Depending on the state of the authorization, the buyer (cardholder) receives instructions or confirmation of the order:

- If declined, the buyer (cardholder) is informed and asked to try a different payment method.

- If the authorization is approved by the issuing Bank (Credit Card Associations) then the buyer (cardholder) is taken to the Order Confirmation page.

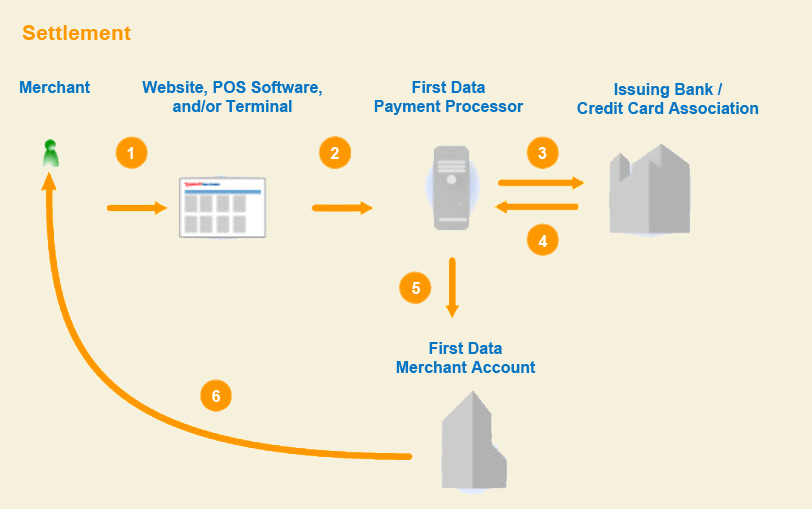

B. Settlement process for FISERV/Ignite Payments compatible merchant accounts

- The merchant signs in to their account and goes to the Order Manager. The merchant reviews the order (including AVS and CVV response codes) for signs of fraud. When ready to complete the sale, the merchant clicks the "Sale" button in the transaction panel of the order. Clicking "Sale" initiates the settlement process. The sale is then stored in a batch for settlement requests which are submitted each night. By default, batches are submitted nightly between 6-11 pm (PST). Merchants can also choose to submit batches manually.

- The settlement request batch with all completed sales is sent to FISERV Merchant Services (FDMS).

- FDMS submits the settlement request for the buyer's order to the Issuing Bank/Credit Card Association of the buyer on behalf of the merchant.

- The Issuing Bank/Credit Card Association sends the response to the settlement request back to FDMS. If the request is accepted, the buyer (cardholder)'s account is debited for the amount of the order. It is possible that the settlement request will be declined; for example, if the buyer has exceeded their credit limit between the time of the authorization and settlement.

- FDMS sends the approval and details of the payment to the merchant's bank (Merchant Account Provider). The settlement of funds between the issuing bank and the Merchant Account Provider then occurs.

- Following the settlement, the Merchant Account Provider credits the merchant's account. For information about when funds will be deposited, contact your merchant account provider.

2. How do the new IRS rules for transaction reporting affect me and my merchant account?

Beginning in January 2012, each merchant must recieve a 1099K report of payment card transactions for the previous tax year. For a full explanation of the requirements and how FISERV will comply, download and read the following PDF:

IRS Merchant Transaction Reporting. ![]()

3. What is Near Field Communication (NFC)

Near field communication, or NFC, allows for simplified transactions, data exchange, and connections with a touch. Formed in 2004, the Near Field Communication Forum (NFC Forum) promotes sharing, pairing, and transactions between NFC devices and develops and certifies device compliance with NFC standards. A smartphone or tablet with an NFC chip could make a credit card payment or serve as keycard or ID card. (from Wikipedia)

4. How will the new Google/Android relationship with MasterCard/Citi Group/Verifone change Near Field Communications (NFC)?

Often nascent markets need bold leadership. I think (imho) this gives NFC such a push. Are there hurdles yet to come, of course. I find it funny that people are so dismissive of NFC because it has been around a long time. I will say, Ethernet was around for about a decade before it became ubiquitous and then it was Token Ring from IBM that was so superior. Anyone out there using Token Ring today......didn't think so.

NFC offers consumers convenience, security and a one place for everything on an interactive device. The Magstripe is 50 years old, retire it already.

Google was smart to include Citi, MC and FISERV. Why, because e-companies don't understand the complexity around money, these guys do. The finance guys were smart to partner with Google because these guys don't understand innovation and Google does.

As for Google Checkout failing, luckily Apple didn't listen to the naysayers about how they could never the do the iPhone because Newton sucked.

The future is coming and it will be on your smartphone. (Question and answer from Quora)

5. Google, Citi, MasterCard, FISERV, and Sprint Team Up to Make Your Phone Your Wallet

Google Wallet will enable consumers to tap, pay, and save with their phones

MAY 26, 2011, NEW YORK, NY -- At an event today, Google, Citi, MasterCard, FISERV, and Sprint announced and demonstrated Google Wallet, an app that will make your phone your wallet so you can tap, pay and save money and time while you shop. For businesses, Google Wallet is an opportunity to strengthen customer relationships by offering a faster, easier shopping experience with relevant deals, promotions and loyalty rewards.

"Today, we've joined with leaders in the industry to build the next generation of mobile commerce," said Stephanie Tilenius, vice president, commerce and payments, Google. "With Citi, MasterCard, FISERV, and Sprint we're building an open commerce ecosystem that for the first time will make it possible for you to pay with an NFC wallet and redeem consumer promotions all in one tap, while shopping offline."

Google Wallet is currently in a field test and will be available to consumers this summer. At the event, Google, Citi, MasterCard, First Data, and Sprint introduced Google Wallet and invited additional issuing banks, payment networks, mobile carriers, handset manufacturers, point of sale systems companies and merchants to join the initiative. Read full article

6. Where are things headed with mobile phones and mobile payment services?

While no one can completely predict the future, the following information taken from an Atlantic Trend article about Barry McCarthy, FISERV's General Manager of Asia/Pacific, Alliances and Government Solutions provides some insightful observations about the future. Read the full article here.

In Barry McCarthy’s perfect world, the Vikings in that credit card commercial wouldn’t snarl, “What’s in your wallet?” They’d say, “What’s in your phone?”

McCarthy’s innovations within the field of mobile commerce at FISERV made him a natural to move into a new role last summer as General Manager of Asia/Pacific, Alliances and Government Solutions.

“Asia has wild growth,” McCarthy says. It’s also the first part of the world to adopt new mobile applications, which eventually make their way to the United States.“We are looking at lots of mobile technologies to improve payment acceptance,” McCarthy says. “In some of these developing nations, there just isn’t good landline coverage. So you have to make connections wirelessly, otherwise you can’t accept a card in the first place.”

FISERV’s merchant business is among its fastest growing areas, with a myriad mobile implications. In India, for example, FISERV is using SMS messaging to text merchants every night the balance they received that day from card payments. Other applications would not only provide balance information and updates, but would allow merchants to make inquiries and manage their business from their handset.

“The U.S. is ahead of Asia on some core mobile technologies, but Asia is ahead of the U.S. on some applications and uses of the phone,” McCarthy says. “I was on a panel recently with the president of AT&T and I said really clearly that Asia was ahead and he disagreed.

“His thinking is that the U.S. technologies -- from the handset perspective and towers and network reliabilities -- are ahead of the rest of the world. That’s true, but that’s not my business. My business is about payments and consumer applications and commerce, and Asia is definitely ahead of the U.S. on that usage of mobile technologies.”

However, McCarthy says it will be years before everybody in the U.S. will have a smartphone to function in their daily lives. “If you think about how the mobile marketplace is segmented, there are smartphone users that really get value out of it, and some that just want to be cool,” he says.

The people who just want a phone on which they can talk and send a few texts may be tempted to switch to smartphones as the price comes down. Or they may be tempted by the things the smartphones can do.

Tracking a Pilot Program

McCarthy saw that firsthand in his previous position at FISERV, when he ran the Mobile Commerce Solutions business unit. A 2008 pilot program with the San Francisco Bay Area Rapid Transit Authority (BART) was very successful.

“We went to the consumers and said, ‘We’re going to give you the phone of the future,’” McCarthy says. “It’s got an electronic wallet in it and you’ll be able to tap the phone at terminals and make a payment right out of your phone.”

McCarthy and his colleagues thought the consumer adoption cycle would be long, or that the sample group might not like the phone at all. “What we found is there is no adoption cycle,” he says. “Once a consumer has it in their hand and they see it being used once, they’ve got it.”

In the four-month trial, the 230 riders made nearly 9,000 trips on BART—tapping their phone to open the fare gate. They also could use it at Jack-in-the-Box fast food restaurants.

“The number one thing they said they were dissatisfied about is they didn’t have everything in the leather wallet on the phone,” McCarthy adds. “I don’t need that dumb leather thing anymore, let’s get it all on the mobile device.”

The test group liked the new technology so much, he says with a laugh, “We had a hard time getting the phones back. ‘Oh, no, no, no, this is part of my life I’m not giving that back to you.’”

In November, AT&T, T-Mobile, and Verizon announced the Isis national mobile commerce network. McCarthy says he can’t comment on FISERV’s role, if any, but says, “Because of our position in the marketplace, we will always be involved in electronic payments.”

FISERV has already launched a reloadable mobile device called a Go-Tag, which uses “contactless” technology. A tiny microprocessor chip can be put on a sticker and attached to a phone. It then talks to the point-of-sale terminal via short distance radio waves.

The second step is putting the contactless chip on a micro SD card that can be inserted into the slot of a phone, and FISERV is offering this solution through a partner, Tyfone. The third step will be when it’s fully embedded in the phone like it was in the San Francisco test.

“One of the really brilliant things about mobile technology and one of my favorite data points,” McCarthy says, “is that the mean time to report a lost or stolen card is about 12 hours, but there are people who lose a card and don’t really know about it for weeks.

“If you lose your phone, the mean time to report a lost or stolen phone is under 60 minutes.”

Even More Uses for Your Phone

FISERV is also working on a set of technologies revolving around “provisioning,” which take a credit card from approval to your wallet.

At this time, one of the company’s core businesses is making credit cards on behalf of banks, encoding them, attaching them to a card carrier and mailing them to customers. A little known fact: FISERV is among the largest customers of the U.S. Postal Service. “In the U.S., we support more than 680 million cards on behalf of our financial institution customers as well as prepaid ‘gift’ cards for merchants across the country,” McCarthy says. “In the future, though, if there’s no leather wallet, how are you going to get the card instead into the phone?”

First Data is partnering with SK C&C, a South Korean company, to build a solution called Trusted Service Management that will provision the information over the air to your mobile device. If the mobile device is lost or stolen, it will securely re-provision it.

McCarthy predicts that in two years there will be a significant number of phones with contactless embedded in them “and the ability to manage your life from the phone.”

FISERV also has a new solution called eGift social which ties gift-giving to social networks like Facebook. For instance, someone with a friend who likes Cold Stone Creamery can send the friend a hot fudge sundae through Facebook or e-mail. Recipients can use the redemption code in-store or online, and users with a Web-enabled mobile phone can just bring in their phone to show the clerk the code. If the message is sent through Facebook, the solution also posts a message to your Facebook wall, so others can learn about the application and send gifts too.

McCarthy was honored in November as the recipient of the prestigious Atlanta Telecom Professional of the Year award. “It was a true honor to be recognized with such a distinguished award and to share it with the exceptional Mobile Commerce team at FISERV,” according to McCarthy. “We have made great strides this year toward our vision of migrating everything consumers do with a leather wallet to an electronic wallet stored on a mobile phone. We are especially proud to be recognized for our work on eGift Social, an application that allows consumers to deliver gift cards from Facebook to an individual’s phone, and our partnership development of an NFC-enabled microSD card. This award is both affirmation of FISERV’s work in the mobile commerce space as well as our decision to make Atlanta our new home.”

7. What are the Interchange Table rates for Visa and Mastercard?

The Interchange Tables are extensive. Here are the three major tables (PDF):

- Visa U.S.A. Interchange Reimbursement Fees (Visa Credit Cards)

- Interlink Interchange Reimbursement Fees (Visa Debit Cards)

- Mastercard Worldwide U.S. and Interregional Interchange Rates

8. What are the California Public Utilities Commission's (CPUC) requirements for diversity in contracting?

The public utilities code requires the commission to establish procedures for utilities to submit plans for increasing the involvement of women, minority, and disabled veteran business enterprises (WMDVBE). If you are a gas, electric, or telephone utility with gross annual revenues exceeding $25M, you should review PUC General Order 156 to ensure compliance.

9. What are the requirements of the Payment Card Industry Data Security Standard (PCI DSS)Compliance Program?

The Payment Card Industry Data Security Standard (PCI DSS) is an information security standard for organizations that handle cardholder information for major debit, credit, prepaid, e-purse, ATM, and POS cards. The standard is defined by the Payment Card Industry Security Standards Council. The current version is 2.0.

Version 2.0 has 12 requirements:

- Install and maintain a firewall configuration to protect cardholder data

- Do not use vendor-supplied defaults for system passwords and other security parameters

- Protect stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Use and regularly update anti-virus software on all systems commonly affected by malware

- Develop and maintain secure systems and applications

- Restrict access to cardholder data by business need-to-know

- Assign a unique ID to each person with computer access

- Restrict physical access to cardholder data

- Track and monitor all access to network resources and cardholder data

- Regularly test security systems and processes

- Maintain a policy that addresses information security

NOTE: There are additional guidelines for wireless environments.

PCI DSS was developed and is maintained and updated by the PCI Data Security Council. All the current information and documents are available from their website www.pcisecuritystandards.org

10. What is the best way to handle chargebacks?

The chargebacks mechanism exists primarily for consumer protection. U.S. credit card holders are afforded reversal rights by Federal Reserve Regulation Z under the Truth in Lending Act. U. S. debit card holders are guaranteed reversal rights by Federal Reserve Regulation E under the Electronic Funds Transfer Act. Similar rights extend globally pursuant to the rules established by the corresponding card association or bank network.

Obviously, as a merchant, you work hard to provide the best possible service and/or products to prevent getting chargebacks, but inevitably they will happen. Here's how merchants can best stay on top of things and handle them:

- The most important thing is to develop the habit of looking for chargeback notices regularly on Mymerchantoffice (MMO). It's best to take action on them as quickly as possible so we don't recommend waiting for the notice to come by mail

- Once you see one, you can call and request documentation to dispute it

- Each chargeback is identified with a case number and this needs to be included in all correspondence with FISERV

- It’s up to you, the merchant, to track the response and any reversals that happen

- The phone number for the chargeback dept is 1-877-274-7915 option 5, then press 0 to talk to a live rep

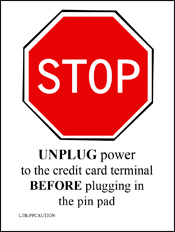

11. My PIN pad has stopped working - what do I do?

Contact your Ignite Payments sales representative and explain the problem. Your sales rep will provide information for shipping the problem terminal. Turn around time can be up to three weeks.

back to top

back to top