Why Fairmed Is The Best Provider For Your Utility’s Merchant Processing

Why Fairmed Is The Best Provider For Your Utility’s Merchant Processing

Fairmed, Inc. is a service-connected

Disabled Veteran Business Enterprise

Ignite Payments-Fairmed and its DVBE Affiliate Program are wholly owned by Fairmed Inc.

DVBE/CPUC Certification #1238360

Learn how Ignite Payments-Fairmed/Fairmed can help you achieve your diversity spend goals.

If your company’s goal is to increase your DVBE Spend, then part of the challenge is finding a Prime or Tier Two DVBE that provides enough service, and therefore dollar expenditure, to move the needle.

We provide a 1.7 percent average figure, but the DVBE Spend amount is actually a variable based on three factors.

- The type of transaction: face-to-face or online (card not present)

- The type of credit card issued/used: rewards and/or business cards

- The type of sale: your business vertical: utility, education, retail, etc.

Click to see exactly how the DVBE spend amount is determined.

Bill Payment Using Credit Cards Increasing

Bill Payment Using Credit Cards Increasing

As documented in a recent case study of DTE Energy by Visa, the use of credit and debit cards by consumers to pay bills, including utility bills, has shown steady increase for the last ten years. The U.S. Postal Service confirms this when they report that there has been a steady drop in bills paid by mail (the vast majority of which contain checks).

As people continue to feel more comfortable shopping on the internet and using their credit cards for online payments, they also tend to use them to pay recurring bills online. Accepting credit and debit cards for utility payments makes great sense for a utility. As highlighted in the study’s table (below), there are several benefits for utilities.

Billers See Top and Bottom-Line |

Billers report that credit and debit cards are a more efficient and effective way to collect revenue.

Utility providers can also experience improvement in operational efficiencies that go right to the bottom line, with lower costs for:

In fact, web-based bill presentment and payment can cost 60 percent less than traditional check-in-the-mail paper-based transactions. |

In light of these benefits and the growing trend, it only makes sense for a utility to accept card payments on a recurring basis. If you’re going to accept credit and debit cards, we can provide the individual attention and support that you need.

Fairmed - What We Offer

a short presentation (6 slides) of the services

we offer and the benefits of doing business with us:

Click to download a PDF version of the presentation ![]()

Three Reasons To Choose Fairmed

Three Reasons To Choose Fairmed

- We make sure you get the best possible service and support

- We provide multi-layered, payment card data security with Clover Security

- We are a CA-certified Disabled Veteran Business Enterprise (DVBE)

1. We make sure you get the best possible service and support

At Ignite Payments-Fairmed/Fairmed, Inc., we work hard to ensure you are getting the best possible service and support – seven days a week – 24 hours a day.

No Hassle Installation and Setup

No Hassle Installation and Setup

If you're accepting credit/debit cards, you need the proper equipment. For many items, especially point-of-sale terminals, the equipment is shipped with no software or initial data. Most other companies leave it completely up to the merchant to do all the work of contacting support, downloading the necessary software features, and then performing the installation and setup. Since most merchants are not IT specialists nor can they afford to contract one, this can be a time-consuming and frustrating process.

Fairmed eliminates the frustration and hassles. Rather than shipping the terminals directly to you, we have them shipped to our offices first. Then we download all the necessary software features (based on our discussion with you), install them, and then perform a complete system test to ensure everything is working correctly.

Your equipment is then shipped to you fully configured for plug-and-play operation. Fairmed wants you to be 100% satisfied with your new equipment and its configuration. To ensure this, once your equipment is received, installed, and operating, we always call you after your first day of credit card processing to discuss operation, make sure you have no problems, and answer any questions. Of course, our Concierge Customer Service does not stop there. As your processing partner, we do regular, periodic follow-up calls to ensure a successful relationship.

In addition to our conceirge-level customer support, Ignite Payments-Fairmed/Fairmed has First Data as our powerhouse backup; with First Data we have the support, experience, and integrity of 37,000+ employees standing behind us.

Online Training

As a merchant, once you are approved you will have access to your online management gateway, Mymerchantoffice® (MMO). MMO is a dedicated merchant website that allows business owners to access their merchant account information online 24/7 and to reach customer service. Using the website, merchants can also reconcile their deposits, retrieve their deposit information, view detailed reports of their chargeback and retrieval histories, and receive prompt answers to questions they submit via e-mail.

However, MMO is not always intuitive. Fairmed conducts personalized training using online collaborative programs, such as GoToMeeting®, to help you learn how to effectively navigate MMO and take advantage of all its features.

Problem Solving

With over 11 years’ experience in the merchant account/credit card processing business, we are, quite frankly, experts at handling any customer problem. If you have any problem or concern, you only need to call us and we will quickly determine the source of the problem, discern the most effective remedy, and take action to resolve it efficiently and with the least amount of hassle for you.

2. Raising The Bar On Security:

2. Raising The Bar On Security:

Multi-layered, Payment Card Data Security With Clover Security®

Clover Security – a First Data exclusive… Learn more...watch the video

(Click to download PDF)

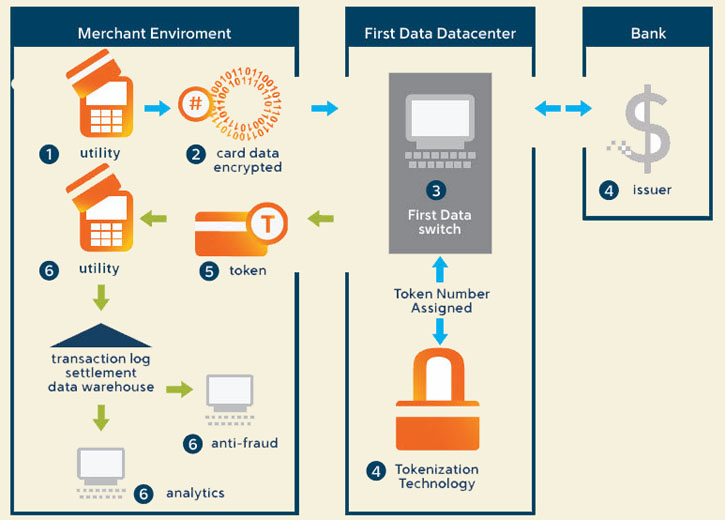

Clover Security combines the flexibility of software- or hardware-based data encryption with random number tokenization. This provides a one-two punch that protects payment card data at every transaction stage—in transit, in use, and at rest—while reducing the challenge and expense of Payment Card Industry Data Security Standard (PCI DSS) compliance. Your terminals must be TransArmour certified to take advantage of this First Data exclusive product, which is free-of-charge.

As is well documented in the media, data breaches are on the rise and criminal focus has recently shifted. Criminals are no longer targeting large corporations and institutions attempting to steal millions of accounts containing credit card and other identity information. The trend now is to attack smaller businesses and organizations. This yields smaller numbers of cards, but small business usually cannot afford enterprise level protection. With Clover Security, you now have world-class protection for your clients' credit card data.

NEW: Visit Clover Security In-Site for detailed information and tools to help better understand and utilize the power and security of Clover Security.

How the Clover Security solution works:

- The consumer provides their card number to the utility using the utility’s secure online interface

- The card data is then encrypted and transmitted to First Data front-end

- First Data front-end decrypts the data payload

- Card data is sent to the issuing bank for authorization and, in parallel, tokenized

- The token is paired with the authorization response and sent back to the utility

- The utility stores the token instead of the card data in their environment and uses the token for subsequent business processes.

3. We are a CA-certified Disabled Veteran Business Enterprise

All other factors being equal, wouldn't you rather do business with a disabled veteran?

The California DVBE program is voluntary program regulated by the California Public Utilities Commission (CPUC). The Commission has set an annual goal of 1.5% DVBE participation in contracts let by California regulated gas, electric, and telephone utilities (and their regulated subsidiaries and affiliates) with gross annual revenues exceeding $25 million (CPUC General Order 156).

CPUC maintains The Supplier Clearinghouse which screens and verifies all DVBEs to ensure eligibility and to save individual utilities the time and expense of verifying individually. Fairmed is a qualified DVBE listed with the Supplier Clearinghouse.

Fairmed, Inc. has been a California Public Utilities Commission certified Disabled Veteran Business Enterprise (CPUC DVBE), Registrant #1238360, since 2010.

When you consider a Merchant Account Provider what factors do you consider?

- Background? Ignite Payments-Fairmed (an Ignite Payments Independent Agency) is owned and operated by a Service-Connected Disabled Veteran who served his country and returned to establish a business with salespeople who also value their country and the opportunities that trustworthy-selling practices provide.

- Price? Life teaches us you usually get what you pay for… nonetheless; we do provide competitive pricing and actively monitor any processing industry changes that can affect our portfolio of Ignite Payments-Fairmed merchants.

- Integrity? Most people would say merchant processing and the word integrity are an oxy-moron. Our customers will tell you we have integrity and consistency for 10+ years as a merchant account acquirer.

- Personal Service? Many merchant processor sales people just sign you up and then move on, often never to be seen again. Our sales people manage their own merchant portfolio and are always your first line of service. Yes, we also have a 24/7 corporate service department, however, our salespeople navigate the corporate morass for you, saving you the time and the hassle of doing it yourself.